Fighting Poverty From the Bottom Up

Fighting Poverty From the Bottom Up

I am very honored to be here today to share with you the experience that we have gone through. Instead of making a speech, I thought I’d just tell you my personal story.

It all started with the independence movement, the independence of Bangladesh 25 years back. All of a sudden we were confronted with war, a lot of bloodshed, a lot of misery; and then it was over, luckily, after nine months. During that period I was teaching here in one of the American universities, and immediately when Bangladesh became independent, I went back to Bangladesh. I thought I would join everybody else to rebuild the nation and create the nation of our dreams, just like anybody who has gone through an independence movement who has committed everything they’ve got into that movement.

As days went by, the situation of Bangladesh did not improve. It started flagging very fast, and we ended up with a famine at the end of 1974. I was teaching economics at that time, at the university, and I felt terrible. Here I was, teaching the elegant theories of economics in the classroom with all the enthusiasm of a brand new Ph.D. from the United States. You feel as if you know everything. You have the solutions. But you walk out of the classroom and you see skeletons all around you, people waiting to die.

There are many, many ways a person can die, but there is no more cruel death than dying of hunger. The death comes inching towards you, and you see it. You are helpless because you can’t find one handfu to put inside your mouth. And the world moves on as if nothing has changed. I couldn’t cope with that situation. I felt that whatever I had learned, whatever I was teaching was all make-believe stories, with no meaning for people’s lives. So I sor of abandoned my academic life, in a way, and I started trying to find out how people lived in the village next door to the university campus, how they inch toward the death that is coming their way.

I wanted to find out, is there anything I can do as a human being to delay it, to stop it, even for one single person? I would go around and sit down with people in the village, talking, and all my arrogance, my academic arrogance, didn’t exist any more. I was no longer trying to solve global problems. I was no longer trying to solve even national problems. I abandoned the bird’s-eye view that lets you see everything from above, from the sky. I assumed a worm’s-eye view-trying to find whatever comes right in front of you, smell it, touch it, see if you can do something about it.

I learned many things along the way, and I tried to involve myself in whatever capacity I had to dissolve those kinds of problems.

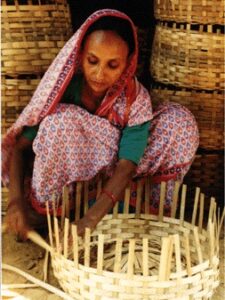

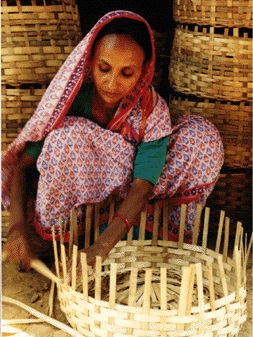

One particular incident took me in a new direction. I met a woman who was making bamboo stools. After a long discussion I found out that she made only two pennies U.S. each day, and I couldn’t believe anybody could work so hard and make such beautiful bamboo stools but make such a tiny amount of profit. So I tried to understand. She explained to me that she didn’t have the money to buy the bamboo to make the stools, so she had to borrow from the trader-and the trader imposed the condition that she had to sell the product to him alone, at a price that he decided.

And that explains the two pennies–she was virtually in bonded labor to this person. And how much did the bamboo cost? She said, “Oh, about 20 cents. For a very good one, 25 cents.” I thought, “My God! People suffer for 20 cents, and there is nothing anyone can do about it.” I debated whether I should give her 20 cents, but then I came up with another idea-let me make a list of people who needed that kind of money. I took a student of mine and we went around the village for several days and came up with a list of 42 such people. When I added up the total amount they needed, I got the biggest shock of my life: It added up to 27 dollars! I felt ashamed of myself for being part of a society which could not provide even 27 dollars to 42 hard-working, skilled human beings.

To kind of escape that shame, I took the money out of my pocket and gave it to my student. I said: “You take this money and give it to those 42 people that we met and tell them this is a loan, but they can pay me back whenever they are able to. In the meantime, they can sell their product wherever they can get a good price.”

After receiving the money, they were very excited. And seeing that excitement made me think more: What do I do now? I thought of the bank branch which was located on the campus of the university. I went to the manager and suggested that he lend money to the poor people that I had met in the village. He fell from the sky! He said, “You are crazy. It’s impossible. How could we lend money to poor people? They are not credit-worthy.” I pleaded with him, I said, “At least give it a try, find out-it’s only a small amount of money.” He said, “No. Our rules don’t permit it. They cannot offer collateral, and such a tiny amount is not worth lending.” He suggested that I see the high officials in the banking hierarchy in Bangladesh.

I took his advice and went to the people who matter in the banking sector. Everybody told me the same thing. Finally, after several days of running around I offered myself as a guarantor. I’ll guarantee the loan, I’ll sign whatever they want me to sign, but they can give me the money, and I’ll give it to the people that I want to.

So that was the beginning. They warned me repeatedly that the poor people who receive the money will never pay it back. I said, “I’ll take a chance.” And the surprising thing was, they repaid me every penny-there was not a single penny missed. I got very excited and came to the manager and said, “Look, they pay back, there’s no problem.” But he said, “Oh, no, they’re just fooling you. Soon they will take more money and never pay you back.” So I gave them more money, and they paid me back. I told this to him, but he said, “Well, maybe you can do it in one village, but if you do it in two villages it won’t work.” So I hurriedly did it in two villages-and it worked.

So it became a kind of a struggle between me and the bank manager and his colleagues in the highest positions. They kept saying that a larger number, five villages probably, will show it. So I did it in five villages, and it only showed that everybody paid back. Still they didn’t give up. They said, “Ten villages.” I did it in ten villages. “Twenty villages.” “Fifty villages.” “One hundred villages.” And so it became a kind of contest between me and them. I come up with the results the cannot deny because it’s their money I’m giving, but they will not accept it because they are trained to believe that poor people are not reliable. Luckily, I was not trained that way so I could believe whatever I am seeing, as it revealed itself But their minds, their eyes were blinded by the knowledge they had.

Finally I had the thought: why am I trying to convince them? I am totally convinced that poor people can take money and pay it back. Why don’t we set up a separate bank? That excited me, and I wrote down the proposal and went to th government to get the permission to set up a bank. It took me two years to convince the government. They said, “Why should you have a bank for the poor people? There are a lot of banks already and we’re having a lot of troubles already, why do you want to create more problems for us?” I said, “We don’t want any money from you, all I want is the permission to set up a bank.”

On October 2, 1983, we became a bank. A formal bank, independent. And what excitement for all of us, now that we had our own bank and we could expand as we wished. And we did expand. Today we work in 36,000 villages in Bangladesh. We have 2.1 million borrowers. We have over 12,000 staff.

When I began, I made two accusations against the banking system: that it is designed to be biased against the poor and also that it is designed to be biased against women. Bankers would get mad at me for saying that. They would say, “How can you accuse us of being anti-women?” I said, “You just give me the list of all your borrowers in all the banks. I’ll bet you cannot come up with one percent of the borrowers who are women. So what would you call it?”

It’s not easy in Bangladesh to reach out to women because men are not even allowed to go and address the women in the village. We tried many round-about ways to communicate to the women. The usual response was, “No, I don’t need money. Why should I need money? Give it to my husband.” That was our beginning, and it was repeated village after village, person after person. It takes a long time for a woman to believe that she can take money, and use it, and earn it. The first thing she has to do is find four friends who will join her in a group of five to borrow from Grameen Bank-that’s another hurdle. Finally, she prepares herself. All is settled now. But the day when she will be receiving the money is not a day of excitement. She spends a sleepless night, tossing and turning, debating with herself whether she should go through with it. She has created a lot of problems for the family already, just by being a girl, being a woman. She doesn’t want to add any more trouble in the family by borrowing and not being able to pay back. In the morning, her friends come over and encourage her because they all decided to go through it, and if she drops out, everything collapses. So she will finally agree to go along and receive the first loan, which is about 12 to 15 dollars. What a treasure! She cannot believe that somebody would trust her with such an enormous amount of money. She will tremble. Water will roll down her cheeks. And she will promise to herself that whoever trusted her with such an enormous amount of money, she will not let them down. She will work very hard to make sure that she will pay back every penny of it.

A woman weaves cloth on a handloom. She purchased her materials and equipment with a microenterprise loan.

And she does. Starting from that point, she has to make weekly payments-tiny amounts. Within one year, she is supposed to pay back the entire amount with interest. When she makes her first installment payment, what an excitement-it really came true! She can do it! Even she didn’t believe that she can do it. Now, she can do it! When she pays her second installment, that’s another jubilation. By the time she finishes her loan, she is a completely different person. She has explored herself. She has found herself. Everybody said she was not good, she was nobody. Today she feels she is somebody. She can do things. She can take care of herself and her family.

We noticed so many good things happen in the family when the woman is the borrower in the family instead of the man. So we focused more and more on women, not just 50 percent. And today, we are 94 percent woman in the bank.

We reached the first billion dollars in total loans two years back, and we celebrated it. A bank which started its journey with 27 dollars, giving loans to 42 people, coming all the way to a billion dollars in loans, is a cause for celebration, we thought. And we felt good. Nobody had believed in us, everybody said, well, you can give tiny amounts to tiny people-So what? You cannot expand, you cannot reach out to a the poor people. So coming all the way to a billion dollars in loans to so many borrowers was quite an excitement. The next year we gave $200 million in one year. Last year we gave over $400 million as loans. This year it will be over a half a billion dollars. So very soon, maybe we will be giving a billion dollars a year, not just over seventeen years.

We had no experience of running an organization. I was just a teacher at the university, I never ran any corporations anything. And so with my colleagues. They had no experience, we just picked them up as we went along. Most of them are my students. Now we find out that we are running a big organization in Bangladesh. But we feel that we are doing OK! I should mention that for all other banks in Bangladesh put together, the combine total in rural loans does not add up to $400 million.

Now I can say to my banking colleagues: “You said poor people are not credit-worthy. For 20 years they have been showing every day who is credit-worthy and who is not, because in Bangladesh it is the rich people who acce bank loans and they are the ones who never pay back. But here, poor people are paying back; our recovery record has remained over 98 percent all the way along.”

I say, “Now the legitimate question to as is: Are the banks people-worthy?”

Research on Grameen Bank has been piling up because everybody says there must be some trick in it, this fellow is not reporting it right, he’s hiding things. So people get excited to go and find out what the real truth is, and everybody launches their research project on Grameen bank, including the World Bank. All reports say the same thing, and we feel good because they come with a lot of hostility but when they finish their work they become great admirers of Grameen Bank.

Researchers say the income of all borrowers is steadily increasing. The World Bank report says one third of the borrowers have clearly crossed over the poverty line. One third are just about to cross the poverty line, it can be expected in a matter of months. The last third is raising their level.

If you can run a bank, lend money, get it back, cover all your costs, and make profit, and people get out of poverty, what else do you want?

I did not attend the population conference in Cairo, but I read a lot of reports, and a lot of people wrote to me. One of the topics discussed in Cairo was Grameen Bank. Business Week ran a cover story on the Cairo conference and half of the cover story was devoted to Grameen Bank. The issue was population. The studies show that the adoption of family planning practices within Grameen families is twice as high as the national average. Why is this? We are not a family planning organization, we are simply a bank, but there must be something in it: when people start making their own decisions about life, they also start making decisions about the size of their families.

Sanitation in Grameen families is much better than non-Grameen families, housing in Grameen families is much better than in non-Grameen families, nutrition in Grameen families is much better than non-Grameen families. We give housing loans, 300 dollars. With that 300 dollars they build a house with a tin roof and concrete columns and a sanitary latrine. It appears to them as a royal palace. Never in their life were they taught that they would ever even enter a house with a tin roof. We have given more than 350,000 of these housing loans, and we have had no trouble in getting our money back. Are poor people credit-worthy? Will the world still wait to find evidence whether the poor are credit-worthy, do they care to find evidence?

I keep saying that poverty is not created by the poor people. Poverty is created by the institutions we have built around us. We have to go back to the drawing board, redesign those institutions so that they do not discriminate against the poor, because the present ones do. We hear about apartheid. We feel terrible about it. But the apartheid practiced by the financial institutions-we don’t hear anything about that. Why should some people be rejected from the financial institutions simply because it is taught that these people are not credit-worthy?

Now, today, if you added up all the evidence, where would you stand? I think it is the responsibility of any human society to insure human dignity for every member of that society. I don’t think we have done very well on that. Poverty, if you look at it a different way, is a denial of all human rights. We talk about human rights, but we don’t link human rights with poverty. It’s not a denial of only one human right-you put them all together, and that spells poverty.

To our knowledge, 56 countries are now involved in Grameen-type programs, including the United States. But it’s not yet gaining the momentum that it needs: 1.3 billion people are still earning a dollar or less a day on this planet, suffering from extreme poverty. If we can create institutional facilities to reach them with credit, they will have the same experience that we have in Bangladesh through Grameen Bank. There’s no reason why anybody should be poor in the whole world.

With this idea we are trying to organize a micro-credit summit next year in Washington, D.C., inviting everybody on this planet to come and join us. The goal of the summit is to try and reach 100 million of the poorest families on this planet with credit for self-employment preferably to the women in those families-by the year 2005.

If we can do that, reach 100 million of the poorest families in the next five years, we’ll be laying down the foundation to create a poverty-free world. My fondest dream is th some day our next generations, our children and grandchildren, will go to the museums to see what poverty was like because there will no longer be any on this planet. And they will accuse us, their forefathers, for letting it continue until the 21st century -because there is no good reason why it should have continued. I believe that day will come. I believe we can create a poverty -free world. I am sure many of you do, and many of you who do not believe now will soon believe in it. And together, we’ll create a poverty-free world.